Our Institute

Clinical Trials

Our Science

News

International Patients

- International Patients

- International patient Service Care

- Travel Arrangement and Hospital Admission

- FAQ

- Contact Us

Shenzhen Geno-Immune Medical Institute Ranked Top 2 Globally!

Top 10 R&D Institutions for Immune Cell Therapy Products in 2024 Revealed – The US and China Dominate 95% of All Clinical Trials

Author: GIMI - Chengwei Chang

Who is leading the innovation in the breakthrough year for immune cell therapy product development? 2025 is undoubtedly an epoch-making "breakout year" for immune cell therapy. From CAR-T therapy for autoimmune diseases named as one of Science's Top 10 Breakthroughs of the Year, to T cell therapies (TIL and TCR-T) breaking through the barriers in solid tumor treatment, to the global launch of multiple blockbuster products, this revolutionary therapy is striding from the lab towards industrialization, profoundly changing the treatment landscape for cancer and other major diseases.

In this global race for innovation, the US and China demonstrate absolute leading advancements. The latest data show that as of the end of 2024, 1,040 immune cell therapy products have entered the clinical trial stage globally. Among these, 502 products (48.3%) are conducting trials in the United States, while China follows closely with 489 products (47.0%). Together, the US and China account for over 95% of global clinical trial activities! Europe (56, 5.4%), Canada (34, 3.3%), the UK (34, 3.3%), and South Korea (33, 3.2%) rank next. So, behind this vast number of clinical trials, which R&D institutions are the true "innovation engines"?

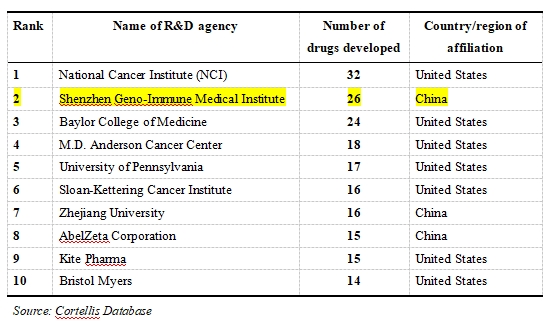

According to statistical analysis by the authoritative Cortellis database (as of the end of 2024), the Top 10 list of global R&D institutions with immune cell therapy products in clinical stages has been officially released. This list clearly outlines the current global distribution of immune cell therapy R&D power:

Table 1: The Top-10 Rank of R&D Institutions with Immune Cell Therapy Products in Clinical Stages (as of end-2024)

Insights from the Ranking:

· US Leadership, Leading Expertise: US institutions dominate the Top 10, occupying 7 spots (1st, 3rd, 4th, 5th, 6th, 9th, 10th). This fully reflects the US's long-accumulated scientific strength in this field, its top-tier research hospitals/cancer centers, and its robust biopharmaceutical ecosystem. The University of Pennsylvania and Memorial Sloan Kettering Cancer Center are the birthplace of CAR-T cell therapy, while Kite Pharma and Bristol Myers Squibb have successfully brought products to market.

· Rise of China Power, Shenzhen Shines: Chinese institutions hold 3 spots: Shenzhen Geno-Immune Medical Institute (GIMI) ranked second globally, Zhejiang University in the 7th place, and AbelZeta (formerly Cellular Biomedicine Group - CBMG) in the 8th place. GIMI focuses on R&D of CAR-T and other immune cell therapy products, with a pipeline of up to 26 products currently in clinical trials (including CAR-T, CTL, UCART, DC etc.) across multiple fields such as hematologic malignancies, solid tumors, and autoimmune diseases. This positions GIMI second only to the US National Cancer Institute (NCI) in pipeline size, demonstrating formidable innovation vitality and ambition.

· CAR-T Focus, Diversification Emerging: While CAR-T cell therapy (59.7% of products in clinical stages) remains the dominant force, institutions on the list also extensively searching other products such as TCR-T, CAR-NK, UCART and TIL. The clinical stages are mainly concentrated in Phase I (560) and Phase II (395), with relatively fewer in Phase III (20), indicating the entire field is still in a vibrant early development stage, especially for new indications like solid tumor and autoimmune disease, and novel products such as CAR-NK, UCART and TCR-T, which hold huge potentials.

Global Standing: The "Chinese Leader" in International Rankings

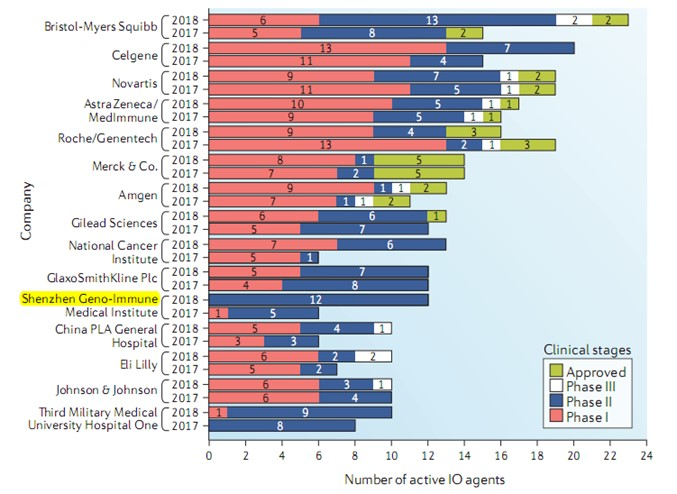

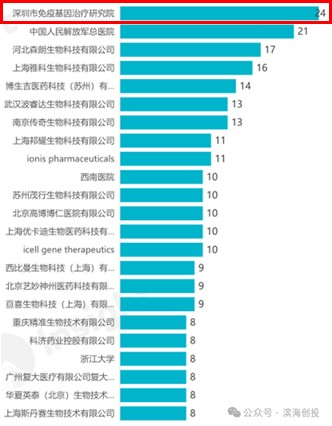

GIMI's research strength has been recognized many times by international authorities:

Source: Nature Reviews Drug Discovery

Source: 2022 BioClub

Future Outlook: Innovation and Diversification are Key

As the CAR-Ts targeting CD19 and BCMA face increasing homogeneity, and more novel therapies (e.g. allogeneic/off-the-shelf UCAR-T, CAR-NK, TCR-T, CAR-M, CAR-Treg) show significant promise, future competition will increasingly focus on pioneering innovation and diversification:

· Conquering Solid Tumors & Autoimmune Diseases: This is key to expanding market potentials.

· Developing "Off-the-Shelf" Products: Addressing the high cost and long manufacturing time of autologous cell therapies (e.g., allogeneic UCAR-T/CAR-NK).

· Optimizing Processes to Reduce Costs: Achieving automated, scaled-up production to improve accessibility.

· Combination Therapies: Exploring synergistic effects of immune cell therapies with antibodies, vaccines, and other treatments.

China provides fertile ground for local innovators like Shenzhen Geno-Immune Medical Institute (GIMI), AbelZeta, Bioray Laboratory, and Simnova Therapeutics through policy support (e.g., the new "Industrial Structure Adjustment Guidance Catalog" listing cell therapy as highly encouraged; specialized policies in Beijing, Shanghai, Tianjin) and capital investment (significant funding raised by multiple domestic immune cell therapy companies in 2024).

Conclusion:

The 2024 global Top 10 ranking of immune cell therapy R&D institutions vividly illustrates the US-China leadership in global innovation competition. The US maintains dominance through deep-rooted scientific expertise, while China, spearheaded by forces like the Shenzhen Geno-Immune Medical Institute (GIMI), is catching up at an astonishing pace and securing a place at the forefront. Anchored by 60 clinical trials and backed by its Top 25 global R&D strength, GIMI represents China on the international stage of cell and gene therapy. From tackling solid tumors and autoimmune diseases to reshaping genetic disease treatment paradigms, its innovation trajectory confirms Nature's prophecy:

"Cell therapy will redefine the future of the pharmaceutical industry."

— And Shenzhen Geno-Immune Medical Institute (GIMI) represents China's key contributor in this transformation.